Forecast 2023: Is Tech Dying? No – Consumers Aren’t Buying

Tech news can be quite alarming lately. With major layoffs at Twitter, Amazon, Facebook/Meta, Stripe, Airbnb, Asana, DoorDash, AirTable, and other major tech companies things seem scary in the tech world. Even Salesforce, the largest private employer in San Francisco with over 70,000 employees worldwide, did a 4% workforce reduction and is losing top executives like co-CEO Brett Taylor. All the tech stock gains from the “pandemic bump” are gone. And the economic outlook is confusing at best and recessionary at worst. Finally, in more bad news, the FTX fiasco has finally mortally wounded crypto.

But my question is, how does all this doom and gloom apply to the $4.4 trillion global information technology (IT) sector? And what does the current economic turmoil mean for B2B SaaS companies like Salesforce, ServiceNow, and Snowflake?

In this market analysis I’ll take you through some of the major shifts and see how they apply to enterprise IT versus the consumer Internet. First, we will dive into social media with an explanation about why Facebook/Meta, Snap, Twitter are either self-destructing or are in major decline. Next, we will take a deep dive into the layoff data. Then we will touch on some macroeconomic factors which impact enterprise IT. Finally, I’ll give you an update to my 2023 enterprise SaaS outlook.

Consumers Aren’t Buying

We are now in a post-pandemic period that no one anticipated. As an analyst, I find many facts in opposition and my crystal ball seems cloudy. For example, in one logical development, we saw a recovery in the travel and leisure industries in Q4 2022. But other economic signals are mixed at best. Contrary to the green shoots in travel, the latter half of 2022 shocked Facebook/Meta, Snap, and Twitter with a sharp decline in consumer activity and online advertising spending. This points to trouble ahead for advertising-sponsored endeavors, such as media and streaming companies.

So, why is there a collapse in e-commerce growth and advertising revenues? One reason is that US consumers are dramatically less interested in buying things. Recent historic lows in consumer sentiment as measured by the University of Michigan Surveys of Consumers, points out the weakness. Just before the pandemic, the index was at 100, which is equal to the 1962 baseline value. However, in a dramatic collapse, the index recently hit an all-time low of 53.2. The only other time consumer sentiment hit a similar low was in the inflationary 1980 recession.

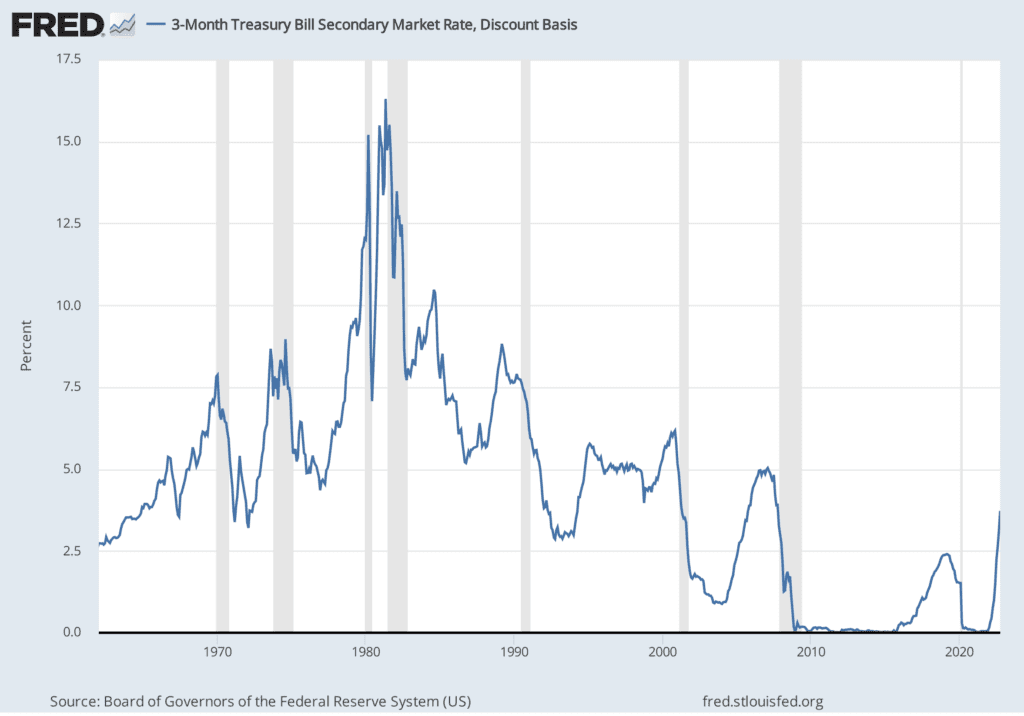

And another key drag on consumer spending are interest rates. In response to the 2008 global financial crisis, the United States central bank set the Fed funds interest rate at or near zero. That policy ended in 2018 and interest rates started being raised back to historic norms. But the pandemic forced interest rates back down to zero again. Now with inflationary pressure and low unemployment we are seeing the sharpest rise in interest rates since the 1980 recession.

So, recent macroeconomic impacts are dire for some consumer Internet companies. They can’t get free Fed money for growth, and their customers are slowing down because credit cards and home loans cost more. Social media advertising has peaked, and the importance of social media apps in daily life is in decline for now.

Layoffs and More Layoffs

In response to lack of demand, consumer tech companies are shedding employees. And there have been a lot of tech layoffs. I have analyzed the layoffs tracker Layoffs.fyi, and it does not look good. And there is no sign the pace of layoffs is slowing down.

When reviewing the Layoffs.fyi data, I trimmed it down to only those reports I could verify. I also excluded most local food delivery services. Also, a significant number of layoff events were excluded due to lack of specific layoff numbers in the reports. As a result, I found 200 layoff events reported between September 22, 2022, and December 10, 2022. I also recoded the industries and locations from the Layoffs.fyi data for summary presentation.

Layoffs are Happening in Tech Capitals

My study of the Layoffs.fyi data found a total of 68,039 layoffs were made worldwide, with 54,100 (80%) in the United States. In the US, 62%, or 33,650, were from San Francisco Bay Area companies. Seattle is second with 24%, or 12,618 layoff reports. Other metro areas impacted include New York, Phoenix, Los Angeles, and Boston.

| Location | # Laid Off |

| SF Bay Area | 33,650 |

| Seattle | 12,618 |

| India | 5,234 |

| New York | 2,316 |

| Singapore | 2,198 |

| Phoenix | 1,613 |

| Israel | 1,612 |

| Brazil | 1,302 |

| Germany | 1,058 |

| Los Angeles | 723 |

| Boston | 648 |

| Canada | 605 |

| Utah, USA | 560 |

| Sweden | 502 |

| San Luis Obispo, California | 400 |

| Chicago | 280 |

| United Kingdom | 271 |

| Austin | 255 |

| Philadelphia | 250 |

| Netherlands | 230 |

| Grand Rapids, Michigan | 226 |

| Ireland | 209 |

| Argentina | 153 |

| Latvia | 143 |

| Columbus | 137 |

| Birmingham, Alabama | 110 |

| Australia | 100 |

| Mexico | 100 |

| Pittsburgh | 100 |

| Dover, Delaware | 76 |

| Norway | 70 |

| Indonesia | 67 |

| Atlanta | 51 |

| Nigeria | 50 |

| Burlington, Vermont | 47 |

| Denmark | 35 |

| Baltimore | 20 |

| Kansas City | 20 |

| GLOBAL TOTAL | 68,039 |

Tech Layoffs are in Social Media, Infrastructure and E-Commerce

When I analyzed the Layoffs.fyi data by industry, I found that most activity was coming from Social Media apps (Facebook/Meta and Twitter) and Amazon. The remainder were spread across 20 categories led by infrastructure, e-commerce, SaaS, real estate, and crypto.

| Industry | # Laid Off |

| Social Media | 14,720 |

| Amazon (Alexa) | 10,000 |

| E-Commerce | 6,833 |

| SaaS | 5,799 |

| Infrastructure | 5,509 |

| Real Estate | 4,985 |

| Crypto | 3,985 |

| Education | 3,694 |

| Finance | 3,428 |

| Healthcare | 1,229 |

| Fitness | 1,200 |

| Media | 1,134 |

| Gaming | 1,100 |

| AgTech | 900 |

| Cybersecurity | 883 |

| Transportation | 748 |

| Marketing | 666 |

| CPG | 400 |

| VoIP | 400 |

| Travel | 226 |

| IT/Consulting | 200 |

| Global Total | 68,039 |

Most layoffs trimmed staff, but a few employment and travel marketplace startups announced closures. Also, some industries have specific problems related to interest rate increases. This has caused some real estate startups to collapse, as well as some fintech startups. It is in Berlin and New York where fintech and real estate firms aren’t just cutting staff but vying for survival.

SaaS Company Layoffs

Let’s dig into the details of the 5,799 SaaS layoffs. Salesforce is the largest company in the SaaS layoff category with 2,090 reported layoffs. It is joined by DocuSign, Zendesk, AirTable, OwnBackup, and UiPath, all with low percentage layoffs. The tenor of the SaaS layoff announcements was a little different too. Salesforce chatter seemed to focus the cutbacks on low performers, and the others were more about making post-pandemic adjustments.

Besides the public companies Salesforce and DocuSign, the most significan pre-IPO SaaS layoffs have occured with AirTable and OwnBackup. In the case of AirTable, their 20% reduction was reported to be a sudden change that included several executive departures, signialing a shift in strategy.

| Company | Location | # Laid Off | Date | % |

| Salesforce | SF Bay Area | 2,000 | 11/7/2022 | 4% |

| DocuSign | SF Bay Area | 671 | 9/28/2022 | 9% |

| Zendesk | SF Bay Area | 350 | 11/7/2022 | 5% |

| Airtable | SF Bay Area | 254 | 12/8/2022 | 20% |

| UiPath | New York | 241 | 11/15/2022 | 6% |

| Hirect | India | 200 | 11/28/2022 | 40% |

| MX | Utah, USA | 200 | 10/11/2022 | |

| Asana | SF Bay Area | 180 | 11/15/2022 | 9% |

| OwnBackup | New York | 170 | 11/15/2022 | 17% |

| Relativity | Chicago | 150 | 12/7/2022 | 10% |

| 6sense | SF Bay Area | 150 | 10/12/2022 | 10% |

| Pipedrive | Latvia | 143 | 11/14/2022 | 15% |

| Adobe | SF Bay Area | 100 | 12/7/2022 | 5% |

| Cognite | Israel | 100 | 12/4/2022 | 5% |

| Gem | SF Bay Area | 100 | 11/1/2022 | 33% |

| BlackLine | Los Angeles | 95 | 12/8/2022 | 5% |

| Salesforce | SF Bay Area | 90 | 10/13/2022 | |

| Rev.com | Austin | 85 | 10/7/2022 | |

| Sketch | Netherlands | 80 | 10/11/2022 | |

| Lokalise | Dover, Delaware | 76 | 11/16/2022 | 23% |

| Aqua Security | Israel | 65 | 12/5/2022 | 10% |

| Notarize | Boston | 60 | 10/31/2022 | |

| Chili Piper | New York | 58 | 11/17/2022 | |

| Mux | SF Bay Area | 40 | 9/29/2022 | 20% |

| CaptivateIQ | SF Bay Area | 31 | 11/15/2022 | 10% |

| DataRails | Israel | 30 | 12/5/2022 | 18% |

| Loom | SF Bay Area | 23 | 10/20/2022 | 11% |

| C2FO | Kansas City | 20 | 12/9/2022 | 2% |

| InfoSum | United Kingdom | 20 | 10/19/2022 | 12% |

| Vee | Israel | 17 | 10/25/2022 | 50% |

| SaaS Total | 5,799 |

Asana, on the other hand, is dealing with a more dire situation. Asana, which was founded five years ago, still loses so much cash that it is in danger of running out of money in the next 12 months if it doesn’t do something.

Given that Asana has runway issues, I did a quick check of other SaaS public companies I track. Fortunately, I found most public SaaS companies that lose money still have enough cash in the bank for at least two years.

Tech Stocks Crashed in 2022

I have an equity tracking system called TechDex that calculates a performance index on 307 technology stocks, with 100 being the value at the beginning of 2022. The year opened with the TechDex equity value at $22.9 trillion and it has now crashed to $14.7 trillion in mid December 2022. This represents a staggering 35%, or $7.9 trillion loss in owner equity value in 2022.

| TechDex Snapshot 12/12/2022 | Market Cap Billions | TechDex Index Basis=Jan-3-22 | |

| Platforms | Internet Core Apps & Infrastructure | $7,909 | 60.54 |

| Semis | Semiconductor Manufacturing | $2,460 | 70.23 |

| Software | Enterprise Software Companies | $1,687 | 68.65 |

| Telco | Telecom Carriers & Equipment | $1,402 | 80.36 |

| E-Commerce | E-Commerce Platforms & Services | $683 | 63.65 |

| Consulting | Global System Integrators & Consultants | $434 | 75.45 |

| Cybersecurity | Cybersecurity Services | $230 | 50.06 |

| Devops | Enterprise Application Delivery | $180 | 50.71 |

| TechDex | All Internet Economy Stocks | $14,940 | 65.21 |

This table shows that enterprise software is in the middle of the pack when it comes to 2022 equity performance. The real drag on TechDex equity are core apps and infrastructure, which have lost over $5 trillion in 2022. Facebook/Meta is an especially bad performing core app, having lost 66 percent of its value.

Strikingly, with the telecoms and global system integrators holding relatively strong, I see some indications that enterprise IT equity loss is less dire. This is especially true when compared to the consumer Internet. However, we also should note that the DevOps and Cybersecurity categories had the worst equity performance. Some contributing factors to this outcome are there are fewer companies in those categories. Plus, many companies had 2021 IPOs, and were subject to stock price run-ups in late 2021.

Silicon Valley in Turmoil

Global venture capital activity is off by 34 percent. The number of new flashy startups is down to zero, the IPO market is closed, and formerly boastful tech bros are pulling in their horns. These facts paint a stark picture for the consumer Internet in 2022. Even in Salesforce devops, venture investing has dropped to zero since the spring.

What happened? The primary reason is the technology stock market is down 35% in 2022. Stock valuations have a direct impact on the wealth of small investor groups, venture capital firms, and the limited partners that fund them. Most people and institutions who fund Silicon Valley are now less interested in pouring cash into risky ventures.

And the crypto implosion has hurt some key Silicon Valley players. The FTX fiasco has fingered venerable Silicon Valley investor Sequoia as a crypto culprit. And this isn’t just any venture capital firm. Sequoia is among the oldest and most successful of venture capital investors. Sequoia’s $200 million investment in FTX helped to legitimize its careless CEO. If FTX had no accounting department, how did that pass the muster of a Sequoia due diligence examination? I am looking forward to further investigations and revelations in the months and years to come.

Crypto doesn’t really impact the real economy, and I’m sorry how real people got caught up in the fever and lost real cash. And the crypto debacle is more of a sociological phenomenon rather than a real problem for the whole economy. However, the long-term effects of crypto’s demise should impact the reputations and futures of those in Silicon Valley with blood on their hands.

The net result of all the turmoil is lower VC activity, less generous investors, and less startup funding activity. For the time being, we should expect new enterprise IT startups to only emerge from self-funded founders.

Tech Labor Market Analysis

Clearly, the good times are over for tech workers in Silicon Valley, Seattle, and other tech hot spots. We could soon see secondary impacts like lower housing costs in the Bay Area. When I reviewed the layoff reports there were two predominant themes. First, most company managers mentioned tightening macroeconomic conditions. And a significant number of CEOs took responsibility for over hiring during the pandemic.

I don’t think the layoffs are over. It could get bad enough for it to feel like a recession in the Bay Area. With social media and the consumer Internet in overall decline, major Internet companies still need to adjust from growth to steady state. We could still see tens of thousands additional tech workers losing their jobs.

It won’t be long until there is more scrutiny at the bloated salaries at the so-called FAANG companies. I expect we will see a seismic shift in hiring practices in Silicon Valley, including chasing out some of those high-salaried workers.

Let’s look at the makeup of those getting laid off from these tech companies, big and small. I think we can break them down like this:

- Senior Career Staff – These are the engineers and senior execs who are wondering if they should retire for a while or bother to look for a job. That’s because many of them were getting paid ridiculous salaries which piled up during the pandemic.

- Mid-Level Career Staff – These are engineering, marketing, and sales staff who have at least five years of experience. These folks are going to have a nice resume when job hunting.

- General Staff – Companies are going to lay off in every department. So not everybody is going to have juicy tech credentials when looking for a new job. But prior tech company experience is going to help assist these job seekers.

- Entry-Level Career Staff – These are the recent college grads, or others who took a risk to move to the Bay Area, New York, or Seattle and now don’t know what to do. In some cases, these are visa holders who need to find a job quick to stay in the United States.

Historical Unemployment Rate is Low

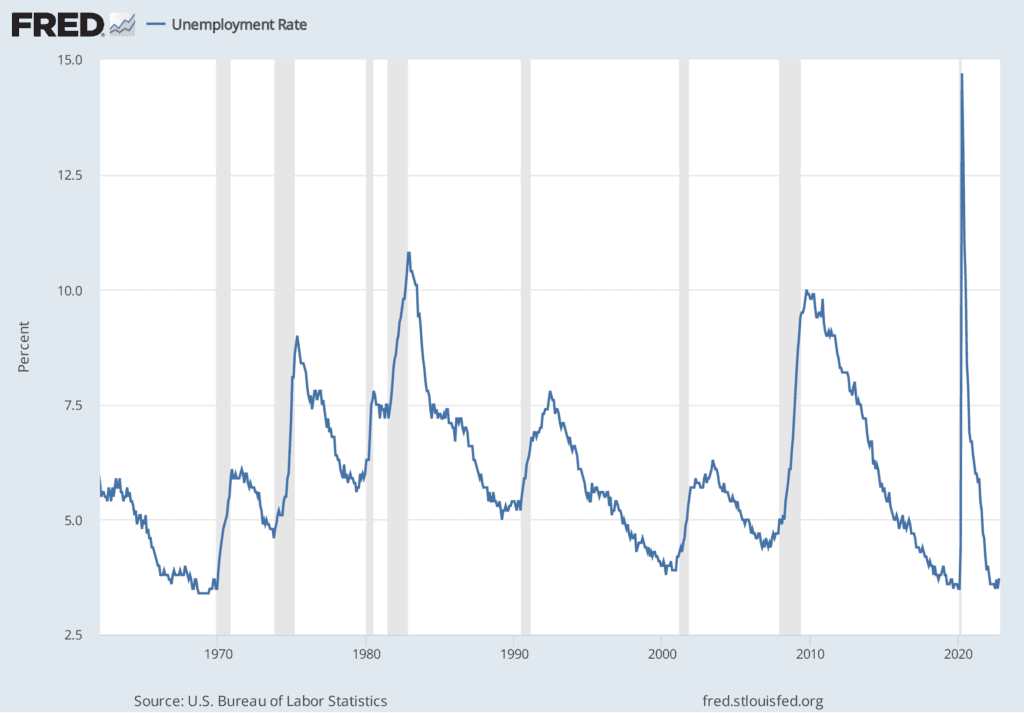

While Silicon Valley layoffs and consumer Internet troubles hit the headlines, data from the U.S. Bureau of Labor Statistics show the opposite. The unemployment rate has still hovered near the pre-pandemic rate of 3.5% for the last several quarters.

Companies in every industry are executing new IT strategies and hiring new staff (see next section for details). The Bureau recently reported that jobs in “Information” have steadily increased at an average of 16,000 per month since 2021. That means all these tech layoffs aren’t yet hitting the economic data being gathered by the US Government.

Tech Talent is Still Needed Everywhere

I believe very few of the senior and mid-career laid off tech workers will find their way to the unemployment lines looking for government support. The good news for everybody is that these former startup or big tech employees have valuable experience in the eyes of regional employers. And, since many recent Silicon Valley hires are now scattered around the USA, those laid off need only look in their local community for opportunities.

And, as we look at the collapse of some tech company business models, the stability of a local government or utility IT job doesn’t look as boring or sad as it used to seem.

Economic Analysis for SaaS

The lack of investor deal flow in enterprise IT startups is concerning. Hopefully, given the spate of high-level departures from Salesforce and other SaaS companies, we will see some founder-funded ideas getting some traction in 2023 and 2024.

But, the overall outlook for SaaS utilization by customers of all sizes is strong. There are still thousands of organizations in the United States who aim to upgrade their digital enterprises. Earlier this year I found that $320B in 2021 enterprise cloud expenditures was still growing at a 20% rate, which shows business’ strong conviction about the cloud.

So, what are the business factors out there that will continue to drive that growth? And, what about the macroeconomic factors which could put a damper on everybody’s spending patterns?

IT Growth Factors

Here is a quick summary on what I believe is driving growth in enterprise IT today.

- Business To the Cloud – We are past the tipping point of moving to the cloud. The best evidence is that new businesses are now built completely with cloud services. We are now in the slow consolidation phase where old on-premises systems will steadily be replaced by cloud computing. That conversion still represents several hundred billion dollars of new total available market (TAM) for cloud computing over the next decade.

- Business Automation – Business managers are always looking for efficiency, and there is still several trillion dollars’ worth of the US economy that has yet to be “eaten by software.” These opportunities include field service automation, small business operations, healthcare, and hospitality business management. Plus, as companies look to downsize their workforce due to economic conditions, they will turn to automation as a replacement.

- Customer Data Platform – Using customer data platform (CDP) systems to compete represents a new wave of IT service adoption yet to fully unfold. Many businesses already have customer relationship management (CRM) and enterprise resource planning (ERP) systems in place. But customer service is never perfect, so companies compete by knowing more about their customers. A CDP enables companies to deliver just-in-time services, improve product delivery, and develop loyalty.

- Digital Transformation – Some business automation projects are so grandiose and ambitious they receive the digital transformation moniker. Digital transformations happen when very large companies execute new strategies designed to automate internal activities, create a CDP, or develop a new service. Enterprises are committed to digital transformation because they believe that without it, they will be overtaken by more modern competitors.

It turns out these IT industry growth factors are so strong, that even in industries with shrinking revenues, companies continue to invest in IT solutions. This was borne out by the recent BLS observations.

Global Economic Factors

So far, I’ve painted a rosy picture for enterprise IT SaaS and jobs in 2023. And I have focused on United States economic factors, leaving out any international analysis.

What else should be considered when thinking about IT spending and growth both inside and outside of the United States?

- Supply Chains – We are moving from a “just in time” world to a “just in case” mentality which causes big countries to “insource” critical industries. I believe the CHIPS Act and other insourcing forces will boost United States tech opportunities in years ahead.

- Geopolitics – The war in Ukraine, the China COVID policy, supply chain shocks, unstable energy supplies, and other events will have unforseeable international economic impacts in 2023.

- Energy Insecurity – The US seems to have put our short-term energy problems behind us, but not so much for the rest of Europe and the U.K. In fact, energy concerns are a major factor in uncertainty concerning any EU or U.K. outlook.

- Inflation and Interest Rates – High interest rates and inflation is still impacting many smaller countries and could return with more supply chain shocks from China.

These factors make the outlook not so rosy for EMEA as it does for North America. So, I would be extra cautious about a deep recession potentially upsetting IT spending plans in Europe and the U.K.

2023 U.S. SaaS Forecast – Partly Cloudy with a Chance of Rain

If the Fed doesn’t overdo it on interest rates, I believe that the strong job market will power the United States through 2023 without the government declaring an economic recession. I am looking for the so-called “Soft Landing.”

We might have a recession in Silicon Valley, but that won’t infect the rest of the country outside of San Francisco, Seattle, and some New York media companies. Some workers will experience hardship, but don’t shed too many tears for senior laid off tech workers. There are thousands of regional companies eager to welcome them to their ranks.

The tech turmoil headlines tell me that social media is in decline, and that most of today’s Silicon Valley was built on the back of advertising revenues. But that is very different from what IT and tech does for the real economy on a global basis. When it comes to producing goods and servicing customers, we are still in the middle of a multi-decade journey of deploying better, human-centered services around industrial and data automation.

So, for enterprise SaaS companies, Salesforce, and the Salesforce ecosystem, my forecast for 2023 remains Partly Cloudy with a Chance of Rain. As Salesforce reminded us in its latest profit predictions, their overall growth predictions are down to 7% from 10%. In other words, things are still growing, but not quite as fast as they would on a bright sunny day.

The tech industry will continue to thin out in 2023 as growth expectations moderate. And the pace of IT hiring and SaaS spending should be less frenetic, but still strong across most industries. Growth will not be universal because some industries or regions will cut back on SaaS spending due to market conditions. And some weaker vendors like Asana will be acquired. But the tide of companies moving to the cloud will keep the cloud, Salesforce, and the Salesforce ecosystem growing in 2023 and 2024.